Improvement / Construction Exchanges

1031 Exchange Multimedia

Improvement Exchanges

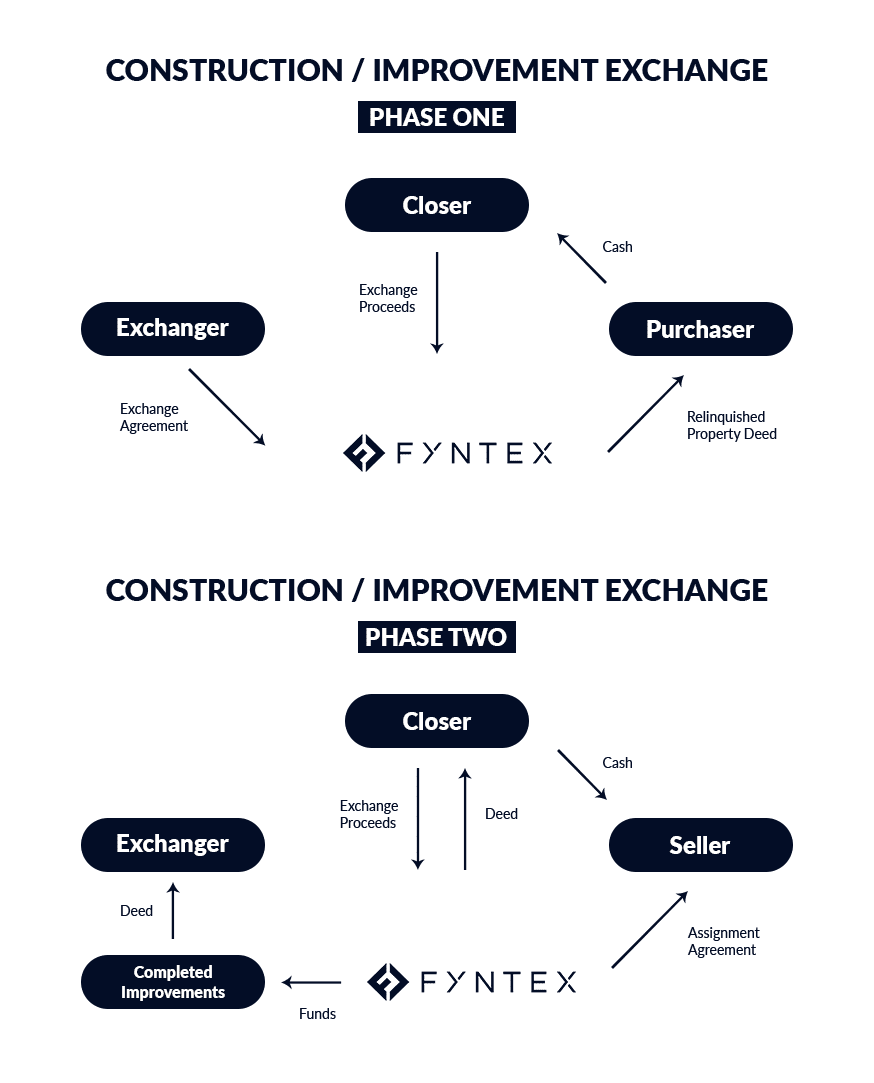

In some cases, the replacement property requires new construction or significant improvements to be completed in order to make it viable for the specific purpose the Exchanger has intended for the property.

Such construction or improvements can be accomplished as part of the exchange process, with payments to contractors and other suppliers being made by the facilitator out of funds held in a trust account.

Therefore, if the replacement property is of lesser value than the relinquished property at the time of the original transaction, the improvement or construction costs can bring the value of the replacement property up to an exchange level or value which would allow the transaction to remain completely tax deferred.