Your 1031 Exchange Guide

Introduction

Although tax deferred exchanging in some form has existed since the 1920's, history alone does not bestow the type of knowledge necessary to determine whether or not your situation would benefit by an exchange.

So for that reason we as closely as possibly will attempt to provide a practical guide to how exchanges work in their most basic form as well as the logistics you can expect when considering an exchange. Before we get started; a caveat. We at Fyntex do not purport that we are the last word on every issue involved with tax deferred exchanging. We are simply practitioners who have probably encountered virtually every exchanging scenario due to the fact they we've been involved in the arena for an extended period. That still doesn't mean you shouldn't discuss your facts and circumstances with a trusted and capable tax advisor. However that said; one thing we have done is to deliberately structure our exchange operational capability and funds security protocols around the relationships we have with our banking partners. These are specific institutions which understand and appreciate our desire to complete and qualify every exchange in a compliant form, without risk to any client exchange funds. Let's be honest, the first two questions any potential Exchanger should consider are: Is my exchange facilitator or Qualified Intermediary properly experienced and equipped to help me? And, how safe will my money (your exchange proceeds) be in their possession? Fyntex thinks we've answered both those questions with our unique approach. First, we believe in complete transparency with our clients. We also understand that prospective Exchangers source information and approach their personal due diligence differently than in the past. Fact is, individuals are perfectly willing to Google their way through information and resources at their own pace and draw their own conclusions about how to do an exchange as well as who will assist them in completing it. That's why we give you all the information we do. We believe you are fully capable of understanding that there are rules with any exchange. And while they are specific, they don't have to be onerous or difficult to accommodate. Our view of both the first question as well as the second has a singular answer. And that answer resides in our unique relationship and reliance upon our exclusive banking partners. We at Fyntex are all long time CPAs, attorneys, and industry veterans and appreciate that the only true security of funds comes when your exchange proceeds are respectfully deposited in a properly restricted, Qualified Escrow Account. This is accomplished through recognized disbursement protocols where no exchange funds ever move without the explicit written authorization of the Exchanger, as well as that of a bank officer. So, about that second question? How safe are your exchange proceeds while in a Qualified Escrow Account with one of our Partner Banks? As safe as they are ever going to be! Remember, our banking partners are all entities that transact all their business and handle all funds entrusted to their custody according to standards established by banking regulators at both the state and federal levels. Such is not the case for all exchange facilitation providers, or lawyers with a trust account.Background

In developing this tutorial, our singular desire is to create a brief synopsis of the fundamentals involved with tax deferred exchanges. Where possible, we will paraphrase directly from the Like-Kind Exchange Regulations issued by the United States Department of the Treasury. However, in cases where the Regulations are considered incomplete or inapplicable, we will seek to isolate those standards or practices which active tax professionals and facilitators consider common and appropriate across the country. Also, in compiling a tutorial of this type, remember that for brevity, it was necessary for us to deal only with those issues arising out of the most common exchange scenarios. Therefore, we have deliberately left out certain obscure exchange nuances or extenuating circumstances in an effort to focus on exchanging basics. As you peruse the tutorial, please keep in mind this caveat: Exchanging can sometimes involve complicated legal and tax issues. And, the failure to comply with applicable Like-Kind Exchange Regulations can jeopardize the potential tax deferred status of your transaction. Therefore, when considering an exchange, seek out the counsel of a qualified legal, tax or exchanging professional. Advise them of the facts and circumstances of your proposed transaction and secure the services of a recognized and respected exchange facilitator.What is a Tax Deferred Exchange?

A tax-deferred exchange represents a simple, strategic method for selling one qualifying property and the subsequent acquisition of another qualifying property within a specific time frame. Although the logistics of selling one property and buying another are virtually identical to any standard sale and purchase scenario, an exchange is different because the entire transaction is memorialized as an exchange and not a sale. And it is this distinction between exchanging and not simply selling and buying, which ultimately allows the taxpayer to qualify for deferred gain treatment. So essentially, sales are taxable and exchanges are not.Internal Revenue Code, Section 1031

Because exchanging represents an IRS recognized approach to the deferral of capital gain taxes, it is important for us to appreciate the components and intent underlying such a tax deferred or tax free transaction. It is within Section 1031 of the Internal Revenue Code that we find the core essentials necessary for a successful exchange. Additionally, it is within the Like-Kind Exchange Regulations, previously issued by The Department of the Treasury, that we find the specific interpretation of the IRS and the generally accepted standards and rules for completing a qualifying transaction.Why Exchange?

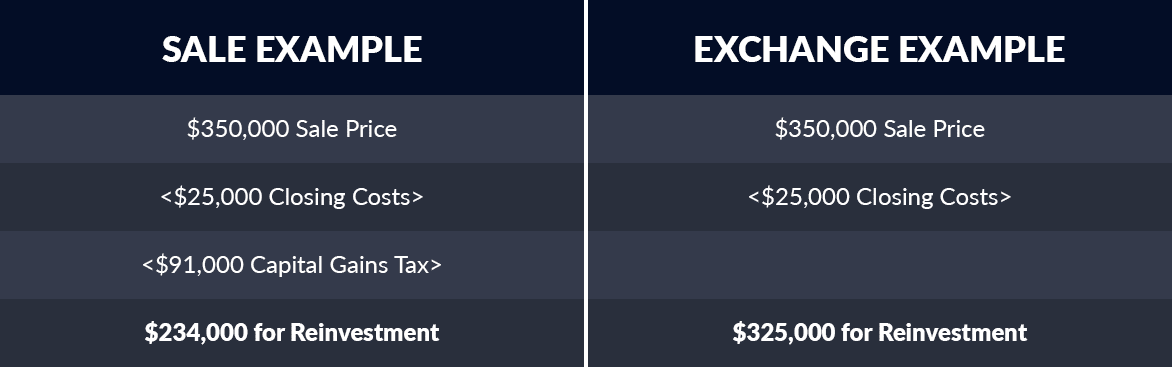

Any property owner or investor who expects to acquire replacement property subsequent to the sale of his existing property should consider an exchange. To do otherwise would necessitate the payment of capital gain taxes in amounts which can exceed 20%-30%, depending on the appropriate combined federal and state tax rates. In other words, when purchasing replacement property without the benefit of an exchange, your buying power is dramatically reduced and therefore represents only 70%-80% of what it did previously. The below diagram illustrates the benefits of exchanging versus selling:

Misconceptions about Tax Deferred Exchanges

Before we continue by identifying the various types of exchange strategies and their associated rules, let´s identify four common exchange misconceptions:All exchanges must involve the swapping or trading with other property owners

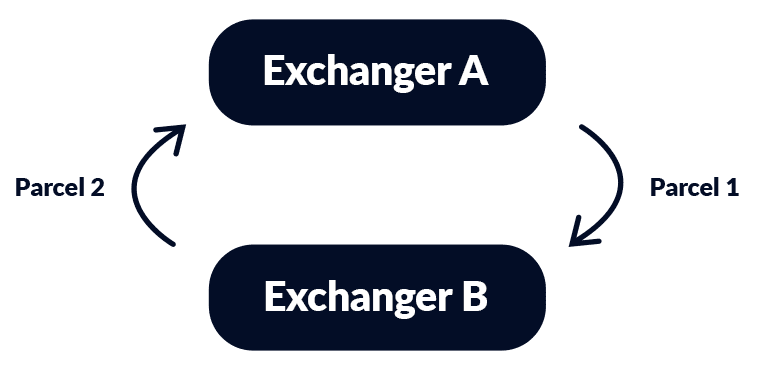

(NO) Before delayed exchanges were codified in 1984, all simultaneous exchange transactions required the actual swapping of deeds and simultaneous closing among all parties to an exchange. Oft times these exchanges were comprised of dozens of exchanging parties as well as numerous exchange properties. But today, there is no such requirement to swap your property with someone else in order to complete an exchange. The rules have been streamlined to the extent that the current process is reflective more of your qualifying intent rather than the logistics of the property closings.All exchanges must close simultaneously

(NO) Although there was a time when all exchanges had to be closed on a simultaneous basis, they are rarely completed in this format any longer. In fact, a significant majority of exchanges are now closed as delayed or deferred exchanges.Like-kind means purchasing the same type of property which was sold

(NO) Although the definition of like-kind has often been misinterpreted to mean that the property being acquired must be utilized in the same form as was the property being exchanged. In other words, apartments for apartments, hotels for hotels, farm for farm, etc. However, the true definition is again reflective more of intent than use. Accordingly, there are currently two types of property, which qualify as like-kind: 1) Property held for investment, and, or2) Property held for a productive use in a trade or business.

Exchanges must be limited to one exchange and one replacement property

(NO) This is another exchanging myth. There are no provisions within either the Internal Revenue Code or the Treasury Regulations which restrict the amount of properties which can be involved in an exchange. Therefore, exchanging out of several properties into one replacement property or vice versa, relinquishing (selling) one property and acquiring several are perfectly acceptable strategies.Parties to an Exchange

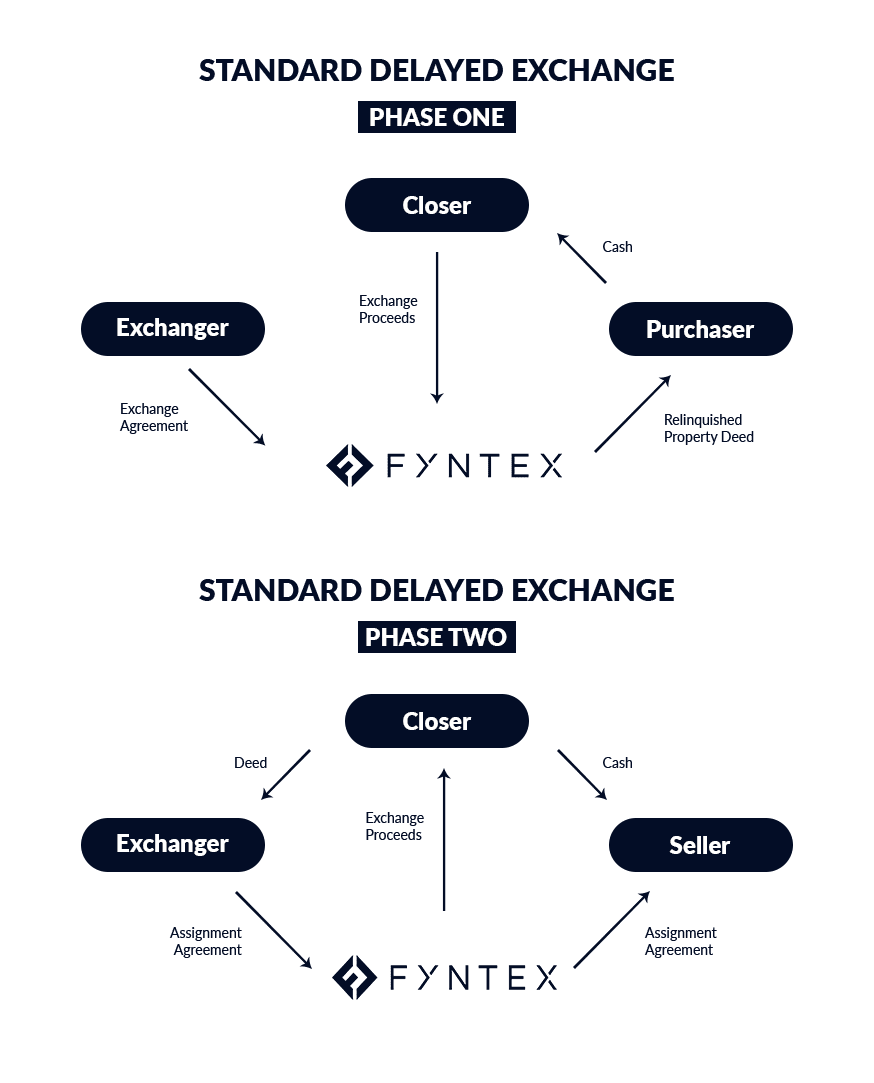

Assuming a delayed or deferred exchange scenario, there are three parties involved in a typical transaction. Upon Phase One (the sale of your exchange or Relinquished Property), they are: the Taxpayer (also called the Exchanger), the Buyer or Purchaser, and the Qualified Intermediary (also called the facilitator) Upon Phase Two (the purchase of your Replacement Property), they are: the Taxpayer (also called the Exchanger), the Seller, and the Qualified Intermediary (also called the facilitator)Basic Exchange Rules (Deferring Capital Gain)

Let us look at a basic concept, which applies to all exchanges. Utilize this concept to fully defer the capital gain taxes realized from the sale of a relinquished property: 1. The purchase price of the replacement property must be equal to or greater than the net sales price of the relinquished property, and2. All equity received from the sale of the relinquished property must be used to acquire the replacement property. 3. Replace your debt. To the extent that either of these rules is abridged, a tax liability will accrue to the Exchanger. If the replacement property purchase price is less, there will be tax. To the extent that not all equity is moved from the relinquished to the replacement property, there will be tax. This is not to say that the exchange will not qualify for these reasons; partial exchanges do in fact qualify for partial tax deferral. It simply means that the amount of any discrepancy will be taxed as boot, or non like-kind property.

Types of Exchanges

Although the vast majority of exchanges occurring presently are delayed exchanges, let us briefly explain a few other exchanging alternatives.Simultaneous Exchanges

As mentioned previously, prior to Congress modifying the Internal Revenue Code as to exchanges and formally approving the concept of delayed exchanging, virtually all exchanges were of the simultaneous type. To qualify as a simultaneous exchange, both the relinquished property and the replacement property must close and record on the same day.

Some investors still try to accomplish simultaneous exchanges, primarily to avoid or reduce the payment of multiple closing fees or exchange fees to a facilitator. There is significant danger and legal exposure in this attempt since many unforeseen events can cause the closing to be delayed on one of the properties, leaving the investor with a failed exchange and the obligation of taxes that would otherwise be deferred. For example, if the properties are located in different counties, it is highly unlikely that the closing can take place on the same day. If two different title, escrow, closing firms or attorneys are involved, it is virtually impossible for both to have the funds to close in their possession on the same day. For instance, with "Good Funds" laws existing in many states, an escrow holder or closer cannot disburse funds not actually in their possession. Further, in directing an escrow holder or closer to disburse funds for the purchase of the replacement property, it could be contended by the IRS that the investor had what is considered "constructive receipt" of the proceeds of the sale, and therefore taxes on the gain would be due. However the 1031 regulations contain what is referred to as a "Safe Harbor" provision, which does provide that in the event a facilitator or intermediary is used in a simultaneous exchange, and the transaction proves not to be simultaneous, the exchange will not fail simply for that reason.

As mentioned previously, prior to Congress modifying the Internal Revenue Code as to exchanges and formally approving the concept of delayed exchanging, virtually all exchanges were of the simultaneous type. To qualify as a simultaneous exchange, both the relinquished property and the replacement property must close and record on the same day.

Some investors still try to accomplish simultaneous exchanges, primarily to avoid or reduce the payment of multiple closing fees or exchange fees to a facilitator. There is significant danger and legal exposure in this attempt since many unforeseen events can cause the closing to be delayed on one of the properties, leaving the investor with a failed exchange and the obligation of taxes that would otherwise be deferred. For example, if the properties are located in different counties, it is highly unlikely that the closing can take place on the same day. If two different title, escrow, closing firms or attorneys are involved, it is virtually impossible for both to have the funds to close in their possession on the same day. For instance, with "Good Funds" laws existing in many states, an escrow holder or closer cannot disburse funds not actually in their possession. Further, in directing an escrow holder or closer to disburse funds for the purchase of the replacement property, it could be contended by the IRS that the investor had what is considered "constructive receipt" of the proceeds of the sale, and therefore taxes on the gain would be due. However the 1031 regulations contain what is referred to as a "Safe Harbor" provision, which does provide that in the event a facilitator or intermediary is used in a simultaneous exchange, and the transaction proves not to be simultaneous, the exchange will not fail simply for that reason.

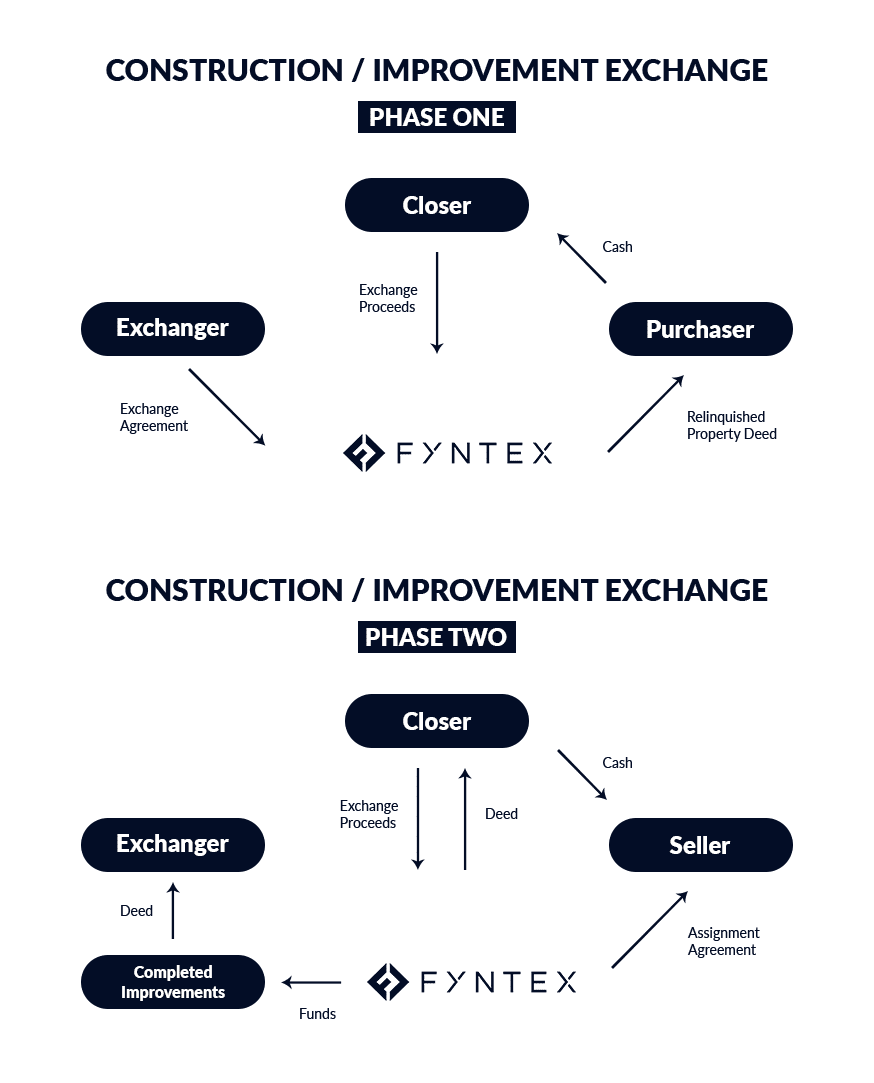

Improvement and Construction Exchange

In some cases, the replacement property requires new construction or significant improvements to be completed in order to make it viable for the specific purpose the Exchanger has intended for the property. Such construction or improvements can be accomplished as part of the exchange process, with payments to contractors and other suppliers being made by the facilitator out of funds held in a trust account. Therefore, if the replacement property is of lesser value than the relinquished property at the time of the original transaction, the improvement or construction costs can bring the value of the replacement property up to an exchange level or value which would allow the transaction to remain completely tax deferred.

In some cases, the replacement property requires new construction or significant improvements to be completed in order to make it viable for the specific purpose the Exchanger has intended for the property. Such construction or improvements can be accomplished as part of the exchange process, with payments to contractors and other suppliers being made by the facilitator out of funds held in a trust account. Therefore, if the replacement property is of lesser value than the relinquished property at the time of the original transaction, the improvement or construction costs can bring the value of the replacement property up to an exchange level or value which would allow the transaction to remain completely tax deferred.

Reverse Exchanges

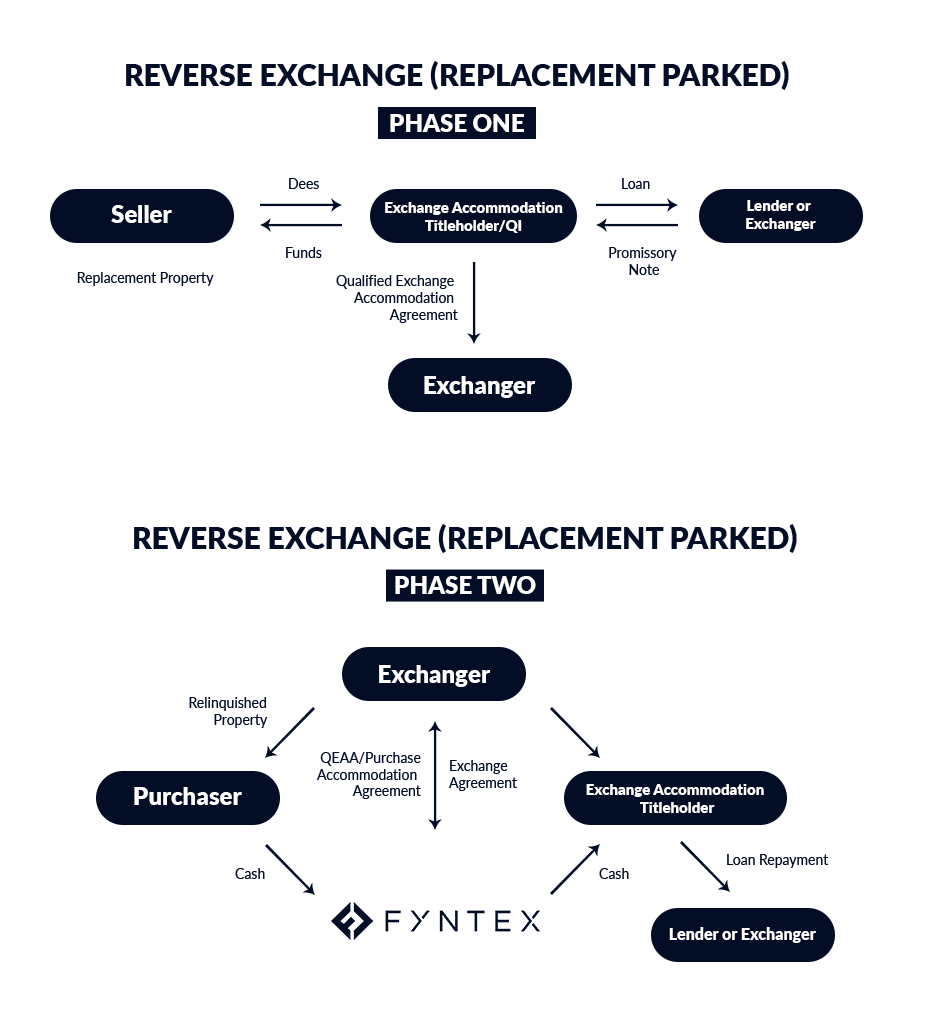

The reverse exchange is actually a misnomer. It represents an exchange in which the Exchanger locates a Replacement Property and wants to acquire it before the actual closing of the Relinquished Property. Since the Exchanger cannot purchase the Replacement and later exchange into property that he already owns, he must find a method to acquire the Replacement Property and still maintain the integrity of his exchange. The most current Reverse Exchange approach is for the Exchanger to arrange the acquisition of the Replacement Property by adding enough cash (or arranging suitable financing) to buy the new property. The title for the new property is then held by an Exchange Accommodation Titleholder (an LLC created by the Qualified Intermediary). The EAT holds title to the Replacement property until such a time within the 180 day exchange period that the Relinquished Proeprty is sold. At that time either the Replacement Property is deeded to the Exchanger by the EAT, or the EAT itself is transferred to the Exchanger. At this point we need to insert several caveats regarding reverse exchanges. They tend to be more complicated than other exchanges and because they involve the holding, parking or warehousing of title by a facilitator in the form of an Exchange Accommodation Titleholder, they require extensive planning. Do not undertake a reverse exchange without the assistance of an experienced and knowledgeable facilitator or intermediary.Reverse Exchange - Replacement Title with EAT

Delayed or Deferred Exchanges

Generally, when one discusses exchanges, the type of exchange referred to is the delayed or Starker exchange. This term comes from the name of the Exchanger who was first challenged for a delayed exchange by the IRS. From this tax court conflict came the code change in 1984 that formally recognized the delayed exchange for the first time. As mentioned earlier, this is now the most common type of exchange. In a delayed exchange, the Relinquished Property is sold at Time 1, and after a delay of up to 180 days, the Replacement Property is acquired at Time 2. The following will represent the traditional rules and time constraints for completing a qualifying delayed exchange:

The following will represent the traditional rules and time constraints for completing a qualifying delayed exchange:

Like-Kind Property

Property that qualifies for exchange under Section 1031 must be "like-kind", which is defined in the Regulations as follows: 1. Property held for productive use in a trade or business, such as income property, or2. Property held for investment. Therefore, not only is rental or other income property qualified, so is unimproved property which has been held as an investment. Such unimproved property can be exchanged for improved property of any type, or vice versa. Also, one property may be exchanged for several, or vice versa. This means that almost any property that is not a personal residence or second home is eligible for exchange under Section 1031.

Time Requirements

The Exchanger has a maximum of 180 days from the closing of the Relinquished Property or the due date of that year's tax return, whichever occurs first, to acquire the Replacement Property. This is called the Exchange Period. The first 45 days of that period is called the Identification Period. During these 45 days, the Exchanger must identify the candidate or target property which will be used for the Replacement Property. The identification must: Be in writing,Signed by the Exchanger, and,

Received by the facilitator or other qualified party (faxed, postmarked or otherwise identifiably transmitted through Federal Express or other dated courier service, or digital signature). This must all occur within the 45 day period. Failure to accomplish this identification will cause the exchange to fail.

Identification

Three rules exist for the correct identification of replacement properties. 1) The Three Property Rule dictates that the Exchanger may identify three properties of any value, one or more of which must be acquired within the 180 Day Exchange Period. 2) The Two Hundred Percent Rule dictates that if four or more properties are identified, the aggregate market value of all properties may not exceed 200% of the value of the Relinquished Property. 3) The Ninety-five Percent Exception dictates that in the event the other rules do not apply, if the replacement properties acquired represent at least 95% of the aggregate value of properties identified, the exchange will still qualify. As a caveat it should be mentioned that these identification rules are absolutely critical to any exchange. No deviation is possible and the Internal Revenue Service will grant no extensions. * Ironically, although only approximately 3-5 percent of exchanges are audited, the few exchanges which don't pass upon audit, typically they fail because of discrepancies in identification.Mechanics of a Deferred or Delayed Exchange

It is important that any exchange be carefully planned with the help of an experienced, competent and creative legal and exchange professional. Preferably one who is completely familiar with the tax code in general, not just Section 1031, and who has extensive experience in doing many different kinds of exchanges. Thorough planning can help avoid many subtle exchanging pitfalls and also ensure that the Exchanger will accomplish the goals which the transaction is intended to facilitate. Once the planning is complete, the exchange structure and timing are decided, and the Relinquished Property is sold and the transaction is closed, the facilitator becomes the repository for the proceeds of the sale. The money is kept in the Exchanger's Qualified Escrow Account until the Replacement Property is located and instructions are received to fund the Replacement Property purchase. The funds are then wired or sent to the closing entity in the most appropriate and expeditious manner, and the Replacement Property is purchased and deeded directly to the Exchanger. All the necessary documentation to clearly memorialize the transaction as an exchange is provided by the facilitator, such as exchange agreement, assignment agreement and appropriate closing instructions.Constructive Receipt

The issue of constructive receipt is one that continues to concern taxpayers, their accountants and tax advisers alike. Over the years that the public has benefited from tax deferred exchanges, various elements of control have been reviewed by the courts in attempting to determine whether the taxpayer has in fact exercised sufficient control over the proceeds from the disposition of the Relinquished Property so as to be considered in receipt of such funds and thereby taxed. Clearly if a taxpayer receives the proceeds from the disposition of his Relinquished Property, the use of terms "exchange" or "Relinquished Property" have no meaning since the transaction will be viewed as a sale and the taxpayer taxed accordingly. Where someone other than the taxpayer receives and controls the use of the proceeds from the disposition of the Relinquished Property, the relationship between that person or entity and the taxpayer is closely scrutinized to determine whether or not it is so closely related to the taxpayer that it can be considered that the taxpayer has constructively received the funds.Selecting Your Facilitator or Qualified Intermediary

There are relatively few federal regulations governing the function of facilitators, other than the fiduciary responsibilities that govern the conduct of any entity holding or handling other people's money. For this reason, care in selecting a facilitator for you or a client's exchange is an important process of evaluation. Select the facilitator as you would an attorney for personal representation or a physician to treat your children. Look for experience in doing exchanges and reputation in the real estate, legal or tax communities. Talk to established escrow and settlement firms or other well known closing professionals that handle exchanges and get their opinion. If possible choose a facilitator who is thoroughly familiar with the process, since many times other aspects of the process will bear significantly on your exchange. For instance, the handling of Promissory Notes, bulk transfers or other variations to the overall transaction. Ask about the security of your funds, and what options you as an Exchanger may have to assure that your funds will be safeguarded. Although the costs and fees for an exchange are relatively insignificant, ask about them, and get a clear explanation of what you will be charged. With a few notable exceptions, fees are very similar, one facilitator to the next. What is of far greater importance is the competence and ability of the facilitator and its personnel to complete your exchange promptly, professionally and legally.Tax Consequences of Exchanging

In order to assess the tax consequences inherent in any exchange transaction, it is first necessary to understand the definition and exchange related meaning of terms such as Cost Basis, Adjusted Basis, Capital Gain, Net Sales Price, Net Purchase Price and Boot. Cost Basis: This is where all tax related calculations in an exchange begin. Cost Basis essentially refers to your original cost in acquiring a given property. Therefore, if the original purchase price of the property you anticipate exchanging was $175,000; your Cost Basis is $175,000. Adjusted Basis: At the time of your exchange it is necessary to determine your current or adjusted basis. This is accomplished by subtracting any depreciation reported previously, from the total of the original cost basis, plus the value of any improvements.

Capital Gain: "Realized Gain" and "Recognized Gain" are the two types of gain found in exchange transactions. Realized Gain reflects the difference between the total consideration or total value received for a given property and the adjusted basis.

Recognized Gain reflects that portion of the Realized Gain, which is ultimately taxable. The difference between realized and recognized gain exists because not all realized gain is ultimately determined to be taxable and issues such as boot can affect how and when gain is recognized.

Net Sales Price: This figure simply represents the sales price, less costs of sale.

Net Purchase Price: This figure simply represents the purchase price, less costs of purchase.

Boot: When considering an exchange of real property, the receipt of any consideration other than real property is determined to be "boot". So, essentially, a working definition of boot is: any property received which is not considered like-kind. And remember, non like-kind property in an exchange is taxable. Therefore, boot is taxable.

There are two types of boot, which can occur, in any given exchange. They are mortgage boot and cash boot. Mortgage boot typically reflects the difference in mortgage debt, which can arise, between the exchange of relinquished property and the replacement property.

As a general rule, the debt on the replacement property has to be equal to, or greater than, the debt on the relinquished or exchange property. If it is less, you'll have what is called "overhanging debt" and the difference will be taxable.

Let's assume for example that you are selling your Relinquished Property for $375,000 and that it has a mortgage of $250,000. At closing, the mortgage will be paid off and the balance of $125,000 will be held by your facilitator.

Suppose that you then find a new property costing $350,000, with a mortgage of $225,000 that you will assume. The assumption of this debt, along with your exchange trust fund of $125,000 will complete your purchase. Under this example you would have to pay tax on $25,000 of capital gains because your debt decreased by that amount.

Likewise, cash boot reflects the amount of cash or other value received.

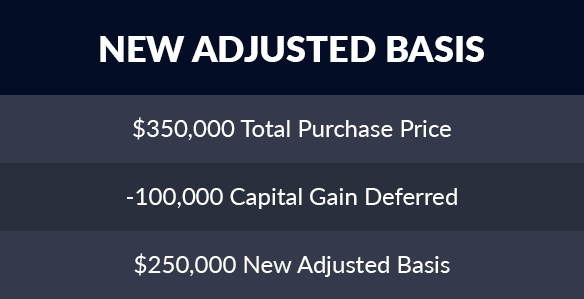

New Adjusted Basis: This figure reflects the necessary adjustments to your basis after the replacement property is acquired. Since the amount of deferred gain must be considered, the calculation below will serve as a method for determining the new adjusted basis on the replacement property.

Adjusted Basis: At the time of your exchange it is necessary to determine your current or adjusted basis. This is accomplished by subtracting any depreciation reported previously, from the total of the original cost basis, plus the value of any improvements.

Capital Gain: "Realized Gain" and "Recognized Gain" are the two types of gain found in exchange transactions. Realized Gain reflects the difference between the total consideration or total value received for a given property and the adjusted basis.

Recognized Gain reflects that portion of the Realized Gain, which is ultimately taxable. The difference between realized and recognized gain exists because not all realized gain is ultimately determined to be taxable and issues such as boot can affect how and when gain is recognized.

Net Sales Price: This figure simply represents the sales price, less costs of sale.

Net Purchase Price: This figure simply represents the purchase price, less costs of purchase.

Boot: When considering an exchange of real property, the receipt of any consideration other than real property is determined to be "boot". So, essentially, a working definition of boot is: any property received which is not considered like-kind. And remember, non like-kind property in an exchange is taxable. Therefore, boot is taxable.

There are two types of boot, which can occur, in any given exchange. They are mortgage boot and cash boot. Mortgage boot typically reflects the difference in mortgage debt, which can arise, between the exchange of relinquished property and the replacement property.

As a general rule, the debt on the replacement property has to be equal to, or greater than, the debt on the relinquished or exchange property. If it is less, you'll have what is called "overhanging debt" and the difference will be taxable.

Let's assume for example that you are selling your Relinquished Property for $375,000 and that it has a mortgage of $250,000. At closing, the mortgage will be paid off and the balance of $125,000 will be held by your facilitator.

Suppose that you then find a new property costing $350,000, with a mortgage of $225,000 that you will assume. The assumption of this debt, along with your exchange trust fund of $125,000 will complete your purchase. Under this example you would have to pay tax on $25,000 of capital gains because your debt decreased by that amount.

Likewise, cash boot reflects the amount of cash or other value received.

New Adjusted Basis: This figure reflects the necessary adjustments to your basis after the replacement property is acquired. Since the amount of deferred gain must be considered, the calculation below will serve as a method for determining the new adjusted basis on the replacement property.

A Few Common Questions and Answers

Equity and Gain Is my tax based on my equity or my taxable gain? Tax is calculated upon the taxable gain. Gain and Equity are two separate and distinct items. To determine your gain, identify your original purchase price, deduct any depreciation, which has been previously reported, then add the value of any improvements, which have been made to the property. The resulting figure will reflect your cost or tax basis. Your gain is then calculated by subtracting the cost basis from the net sales price. Deferring All Gain Is there a simple rule for structuring an exchange where all the taxable gain will be deferred? Yes, if you: 1) Purchase a replacement property which is equal to or greater in value than the net selling price of your relinquished (exchange) property, and2) Move all equity from one property to the other; the gain will be totally deferred. 3) Replace your debt. Definition of Like-Kind What are the rules regarding the exchange of like-kind properties? May I exchange a vacant parcel of land for an improved property or a rental house for a multiple unit building? Yes, like-kind refers more to the type of investment than to the type of property. Think in terms of investment real estate for investment real estate, business assets for business assets, etc. Simultaneous Exchange Pitfalls Is it possible to complete a simultaneous exchange without an intermediary or an exchange agreement? While it may be possible it may not be wise. With the Safe Harbor addition of qualified intermediaries in the Treasury Regulations and the recent adoption of good funds laws in several states, it is very difficult to close a simultaneous exchange without the benefit of either an intermediary or exchange agreement. Since two closing entities cannot hold the same exchange funds on the same day, serious constructive receipt and other legal issues arise for the Exchanger attempting such a simultaneous transaction. The addition of the intermediary Safe Harbor was an effort to abate the practice of attempting these marginal transactions. It is the view of most tax professionals that an exchange completed without an intermediary or an exchange agreement will not qualify for deferred gain treatment. And if already completed, the transaction would not pass an IRS examination due to constructive receipt and structural exchange discrepancies. The investment in a qualified intermediary is insignificant in comparison to the tax risk associated with attempting an exchange, which could be easily disqualified. Property Conversion How long must I wait before I can convert an investment property into my personal residence? A few years ago the Internal Revenue Service proposed a one year holding period before investment property could be converted, sold or transferred. Congress never adopted this proposal so therefore no definitive holding period exists currently. However, this should not be interpreted as an unwritten approval to convert investment property at any time. Because the one year period may or may not reflect the intent of the IRS, most tax practitioners advise their clients to hold property more than two years before converting it into a personal residence. Remember, intent is very important. It should be your intention at the time of acquisition to hold the property for its productive use in a trade or business or for its investment potential. Involuntary Conversion What if my property was involuntarily converted by a disaster or I was required to sell due to a governmental or Eminent Domain action? Involuntary conversion is addressed within Section 1033 of the Internal Revenue Code. If your property is converted involuntarily, the time frame for reinvestment is extended to twenty-four months from the end of the tax year in which the property was converted. You may also apply for a twelve month reinvestment extension. Facilitators and Intermediaries Is there a difference between facilitators? Most definitely. As in any professional discipline, the capability of facilitators will vary based upon their exchange knowledge, experience and real estate and/or tax familiarity. Facilitators and Fees Should fees be a factor in selecting a facilitator? Yes, however they should be considered only after first determining each facilitator's ability to complete a qualifying transaction. This can be accomplished by researching their reputation, knowledge and level of experience. Personal Residence Exchanges Do the exchange rules differ between investment properties and personal residences? If I sell my personal residence what is the time frame in which I must reinvest in another home and what must I spend on the new residence to defer gain taxes? The rules for personal residence rollovers were formerly found in Section 1034 of the Internal Revenue Code. You may remember that those rules dictated that you had to reinvest the proceeds from the sale of your personal residence within twenty-four months before or after the sale, and you had to acquire a property which reflected a value equal to or greater than the value of the residence sold. These rules were discontinued with the passage of the 1997 Tax Reform Act. Currently, if a personal residence is sold, provided that residence was occupied by the taxpayer for at least two of the last five years, up to $250,000 (single) and $500,000 (married) of capital gain is exempt from taxation. Exchanging and Improvements May I exchange my equity in an investment property and use the proceeds to complete an improvement on a vacant lot I currently own? Although the attempt to move equity from one investment property to another is a key element of tax deferred exchanging, you may not exchange into property you already own. You may however, complete an Improvement Exchange which utilizes an Exchange Accommodation Titleholder (EAT), created by the Facilitator, to hold title while improvements are being completed. SE elsewhere for instructions for Improvement or Construction Exchanges. Partnership or Partial Interests If I am an owner of investment property in conjunction with others, may I exchange only my partial interest in the property? Yes. Partial interests qualify for exchanging within the scope of Section 1031. However, if your interest is not in the property but actually an interest in the partnership which owns the property, your exchange would not qualify. This is because partnership interests are excepted from Section 1031. But don't be confused! If the entire partnership desired to stay together and exchange their property for a replacement, that would qualify. Reverse Exchanges Are reverse exchanges considered legal? Yes, although they can sometime become complex and always require appropriate planning. We have a reverse exchange specialist on our team who can help plan and facilitate even the most complex reverse, build to suit or complex transaction. Identification Why are the identification rules so time restrictive? Is there any flexibility within them? The current identification rules represent a compromise which was proposed by the IRS and adopted in 1984. Prior to that time there were no time related guidelines. The current forty-five day provision was created to eliminate questions about the time period for identification and there is absolutely no flexibility written into the rule and no extensions are available. In a delayed exchange, is there any limit to property value when identifying by using the two hundred percent rule? Yes. Although you may identify any three properties of any value under the three property rule, when using the two hundred percent rule there is a restriction. It is when identifying four or more properties, the total aggregate value of the properties identified must not exceed more than two hundred percent of the value of the relinquished property. An additional exception exists for those whose identification does not qualify under the three property or two hundred percent rules. The ninety-five percent exception allows the identification of any number of properties, provided the total aggregate value of the properties acquired total at least ninety-five percent of the properties identified. Should identifications be made to the intermediary or an attorney, escrow, closer or title company? Identifications may be made to any party listed above. However, many times the escrow holder or closer is not equipped to receive your identification if they have not yet opened a transaction file. Therefore it is easier and safer to identify through the intermediary or facilitator provided the identification is postmarked or received within the forty-five day identification period.